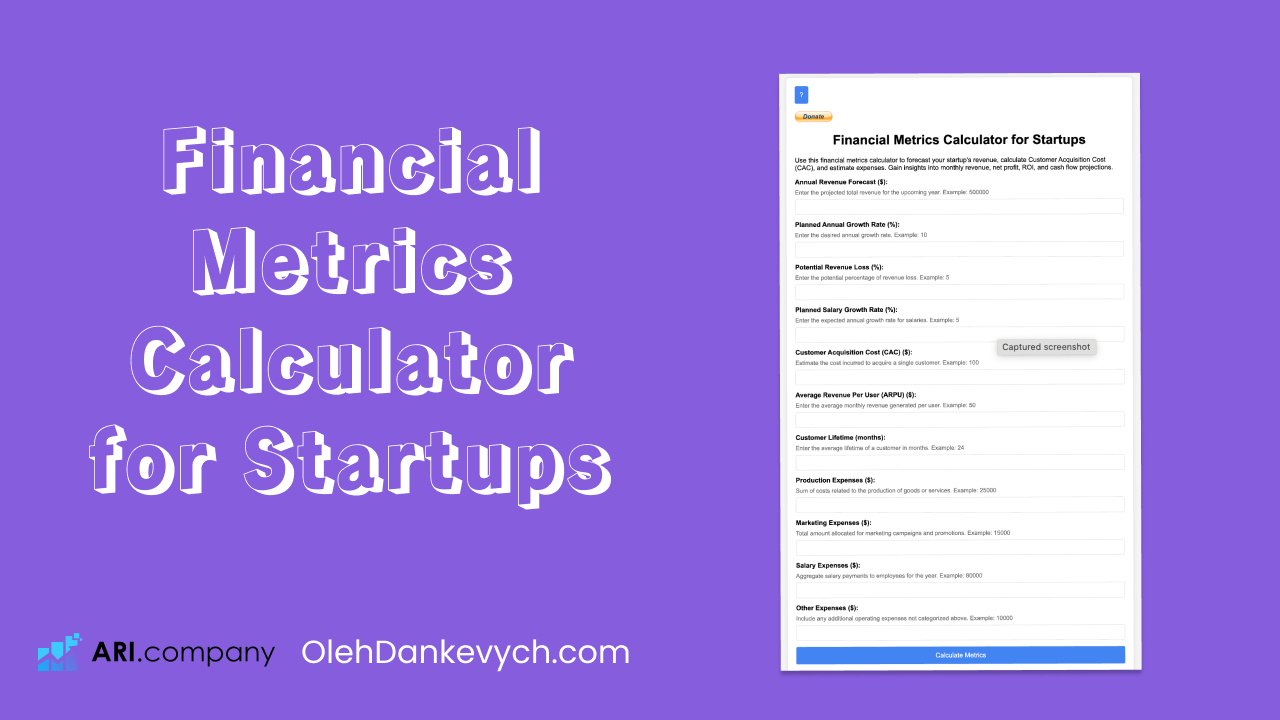

Startup Financial Metrics Calculator

Welcome to my personal blog! Today, let’s explore an incredibly useful tool for entrepreneurs and startups: the Startup Financial Metrics Calculator. This HTML-based calculator helps you refine and optimize your startup’s financial strategy. Let’s dive into why this tool is indispensable and how you can leverage it effectively.

Why Use the Startup Financial Metrics Calculator?

The 🔗 Startup Financial Metrics Calculator is designed to streamline financial planning and decision-making processes for startups. Whether you’re seeking investment, evaluating growth strategies, or simply aiming to understand your financial health better, this tool provides critical insights.

How to Use the Calculator?

Using the calculator is straightforward. Simply follow these steps:

- Annual Revenue Forecast: Enter your expected annual revenue forecast. This sets the baseline for your financial projections.

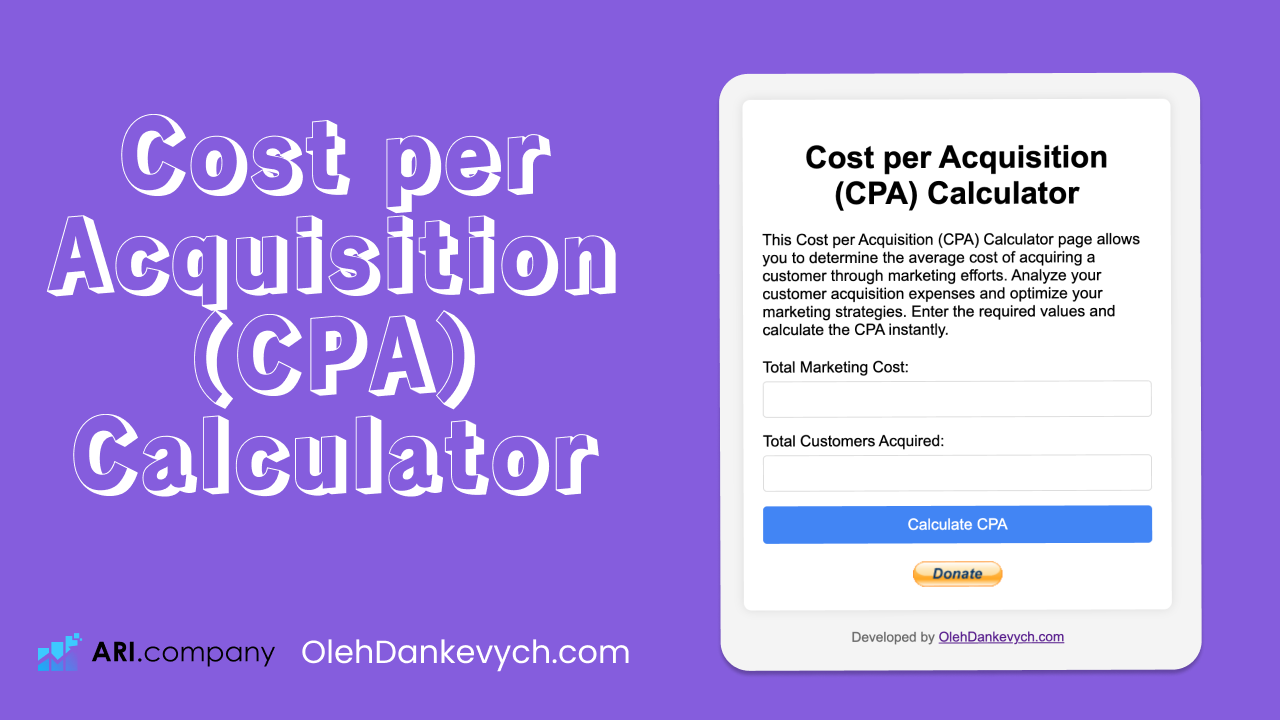

- Customer Acquisition Cost (CAC): Specify your average cost to acquire a single customer. This metric is crucial for assessing your sales and marketing efficiency.

- Monthly Recurring Revenue (MRR): Input your monthly recurring revenue from subscription-based services. MRR indicates your business’s stable revenue streams.

- Lifetime Value (LTV): Define the total revenue expected from a customer throughout their relationship with your business. LTV helps in assessing customer retention strategies.

- Monthly Expenses: Enter all operational costs incurred monthly, such as salaries, rent, and utilities.

- Net Profit: Specify your business’s net profit, which is the revenue left after deducting all expenses.

- Cash Flow: Input your business’s cash flow, reflecting the movement of cash in and out of your business.

- LTV to CAC Ratio: Enter the ratio comparing the lifetime value of a customer to the cost of acquiring them. A higher ratio indicates better profitability.

- Burn Rate: Specify how quickly your business is spending its capital monthly.

- Runway: Define the duration your business can operate before exhausting its current cash reserves, based on the burn rate.

After entering these details, click the “Calculate” button to generate insightful financial metrics and visual representations.

Benefits of Using the Calculator

- Optimized Financial Strategy: Make informed decisions based on accurate financial projections.

- Investor Attraction: Present compelling financial metrics to attract potential investors.

- Operational Efficiency: Identify areas for cost optimization and revenue growth.

- Visual Representation: Visualize your financial data with interactive charts for better understanding and presentation.

Thank you for reading through this detailed overview of the Startup Financial Metrics Calculator. Whether you’re a startup founder, investor, or financial analyst, this tool equips you with essential metrics and insights crucial for sustainable growth and success.

Thank you for your attention and happy calculating!