LTV to CAC Ratio Calculator

Understanding the efficiency of your marketing and sales efforts is essential for business growth. One of the key metrics to assess this efficiency is the LTV to CAC ratio. This ratio compares the lifetime value of a customer to the cost of acquiring that customer. Our 🔗 LTV to CAC Ratio Calculator is designed to help you quickly and accurately calculate this important metric.

What is the LTV to CAC Ratio?

The LTV to CAC ratio is a measure of the relationship between the revenue a customer brings to your business over their lifetime (LTV) and the cost incurred to acquire that customer (CAC). It helps you determine whether your customer acquisition efforts are profitable. The formula to calculate this ratio is:

LTV to CAC Ratio = LTV / CACFor example, if the Lifetime Value (LTV) of a customer is $500 and the Customer Acquisition Cost (CAC) is $100, the LTV to CAC ratio would be:

LTV to CAC Ratio = $500 / $100 = 5This means that for every dollar spent on acquiring a customer, you get $5 back in customer lifetime value.

How to Use the LTV to CAC Ratio Calculator

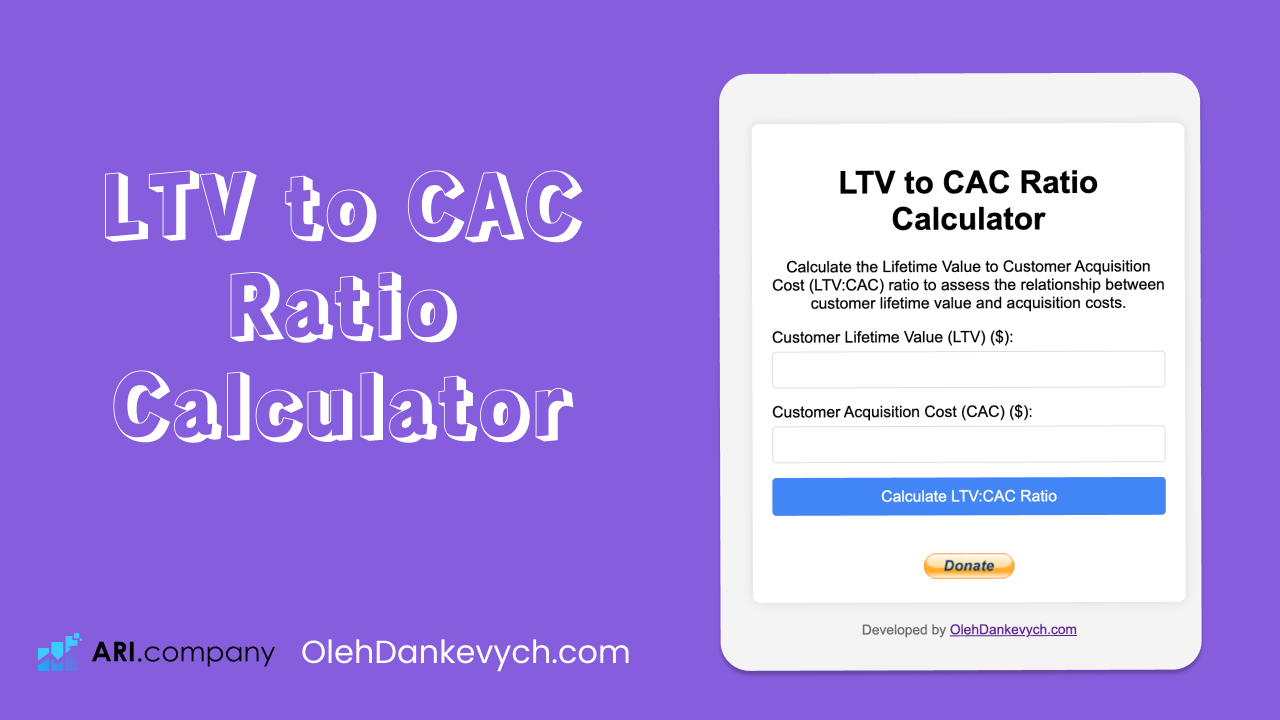

Our LTV to CAC Ratio Calculator is simple and intuitive. Follow these steps to use the calculator:

- Enter the Customer Lifetime Value (LTV): Input the total revenue you expect to earn from a customer over their lifetime.

- Enter the Customer Acquisition Cost (CAC): Input the total cost associated with acquiring a customer.

- Calculate the Ratio: Click the “Calculate LTV:CAC Ratio” button to instantly see your ratio.

Benefits of Using the LTV to CAC Ratio Calculator

1. Assess Marketing Efficiency:

- Quickly evaluate the effectiveness of your marketing and sales strategies by understanding the return on investment (ROI).

2. Make Informed Decisions:

- Use the ratio to make data-driven decisions about your marketing budget and resource allocation.

3. Optimize Customer Acquisition:

- Identify areas where you can reduce costs or increase customer lifetime value to improve your ratio.

Example Scenario

Imagine you run a subscription-based service and want to evaluate your customer acquisition strategies. Suppose you calculate that the average lifetime value of a customer is $1,000 and the average cost to acquire a customer is $200. By entering these values into the LTV to CAC Ratio Calculator, you can quickly determine your ratio:

- Customer Lifetime Value (LTV): $1,000

- Customer Acquisition Cost (CAC): $200

Ratio Calculation:

LTV to CAC Ratio = $1,000 / $200 = 5With an LTV to CAC ratio of 5, you can see that your customer acquisition efforts are profitable, as you earn $5 for every $1 spent on acquisition. This information is crucial for making strategic decisions about scaling your marketing efforts and improving your business’s profitability.

Advantages of the LTV to CAC Ratio Calculator

- User-Friendly Interface: The calculator is designed to be straightforward, making it easy for anyone to use, regardless of technical expertise.

- Instant Results: Get immediate feedback on your LTV to CAC ratio, allowing for quick adjustments and strategic planning.

- Strategic Insights: Leverage the ratio data to optimize your marketing and sales strategies, ensuring better ROI and business growth.

The LTV to CAC Ratio Calculator is a powerful tool for businesses looking to optimize their marketing spend and improve customer acquisition strategies. By providing a quick and accurate measure of your LTV to CAC ratio, it enables you to make informed decisions and continuously refine your approaches. Regular use of this calculator can help you achieve better financial outcomes and drive business growth.

Thank you for reading!

LTV to CAC Ratio Calculator

Calculate the Lifetime Value to Customer Acquisition Cost (LTV:CAC) ratio to assess the relationship between customer lifetime value and acquisition costs.