Customer Lifetime Return on Investment (CLTV: CAC) Calculator

Understanding the financial effectiveness of acquiring new customers is crucial for any business. The Customer Lifetime Value to Customer Acquisition Cost (CLTV: CAC) Calculator is an invaluable tool designed to help you determine this important ratio. By using this tool, you can make more informed decisions about your marketing and customer acquisition strategies, ensuring that you maximize your return on investment.

What is the CLTV: CAC Calculator?

The Customer Lifetime Return on Investment Calculator helps you assess the financial efficiency of your customer acquisition efforts. CLTV represents the total revenue a business can reasonably expect from a single customer account over its lifetime. CAC is the cost associated with acquiring a new customer. The ratio of these two metrics is crucial for understanding the long-term sustainability and profitability of your customer acquisition strategies.

How to Use the CLTV: CAC Calculator

Using the CLTV: CAC Calculator is simple and efficient. Here’s a step-by-step guide:

- Enter Customer Lifetime Value (CLTV): Input the total revenue you expect from a customer over their entire relationship with your business.

- Enter Customer Acquisition Cost (CAC): Input the cost incurred to acquire a new customer.

- Calculate the Ratio: Click the “Calculate CLTV: CAC Ratio” button to see your result.

The formula used by the calculator is:

cltv / cacBenefits of Using the CLTV: CAC Calculator

1. Assess Financial Efficiency:

- Understand if your customer acquisition costs are justified by the revenue generated from customers over their lifetime.

2. Improve Marketing Strategies:

- Make data-driven decisions to optimize your marketing spend and improve customer acquisition strategies.

3. Enhance Business Profitability:

- By maintaining a healthy CLTV: CAC ratio, ensure that your business remains profitable and sustainable over the long term.

Example Scenario

Imagine your business has a Customer Lifetime Value (CLTV) of $1000 and a Customer Acquisition Cost (CAC) of $250. Using the CLTV: CAC Calculator, you can determine:

- CLTV: $1000

- CAC: $250

- CLTV: CAC Ratio:

1000 / 250 = 4In this example, the CLTV: CAC ratio is 4, indicating that for every dollar spent on acquiring a customer, you earn four dollars in return.

Why Choose This CLTV: CAC Calculator?

- User-Friendly: The intuitive interface ensures that you can quickly and easily calculate your CLTV: CAC ratio.

- Accurate Results: Provides precise calculations to help you make informed business decisions.

- Strategic Insights: Leverage the ratio to refine your customer acquisition and marketing strategies effectively.

Conclusion

The Customer Lifetime Value to Customer Acquisition Cost (CLTV: CAC) Calculator is a powerful tool for any business looking to optimize its customer acquisition strategies and ensure long-term profitability. By providing an accurate measure of the financial return on your marketing investments, it helps you make better strategic decisions and allocate resources more efficiently. Use this calculator regularly to stay on top of your customer acquisition metrics and drive your business forward.

Thank you for reading!

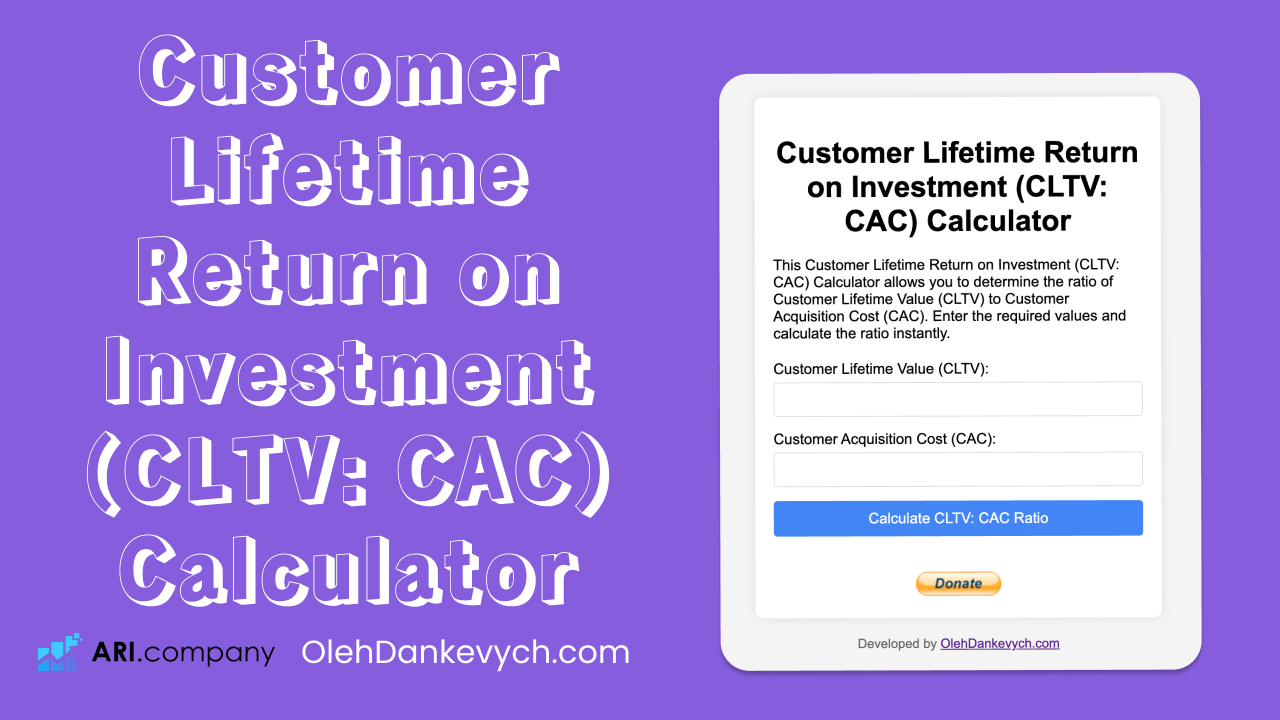

Customer Lifetime Return on Investment (CLTV: CAC) Calculator

This Customer Lifetime Return on Investment (CLTV: CAC) Calculator allows you to determine the ratio of Customer Lifetime Value (CLTV) to Customer Acquisition Cost (CAC). Enter the required values and calculate the ratio instantly.